Man-oh-man! Things have been quite interesting over the last few months. It’s so hard to make sense of it all, but here are things, as we see them:

BY THE NUMBERS

Economic Indicators: Mixed Signals

The U.S. economy contracted by 0.3% in Q1 2025, marking the first decline since early 2022. This downturn was primarily driven by a surge in imports ahead of new tariffs, which widened the trade deficit to a record $140.5 billion. While one quarter of negative growth doesn’t constitute a recession (it takes 2 consecutive quarters), it sets the stage for concern if the trend continues.

That said, since the Q1 report, weekly high-frequency indicators—like ISM services, retail sales, and regional Fed activity—have shown modest expansion, suggesting Q2 may bounce back into slightly positive territory, so we will see…

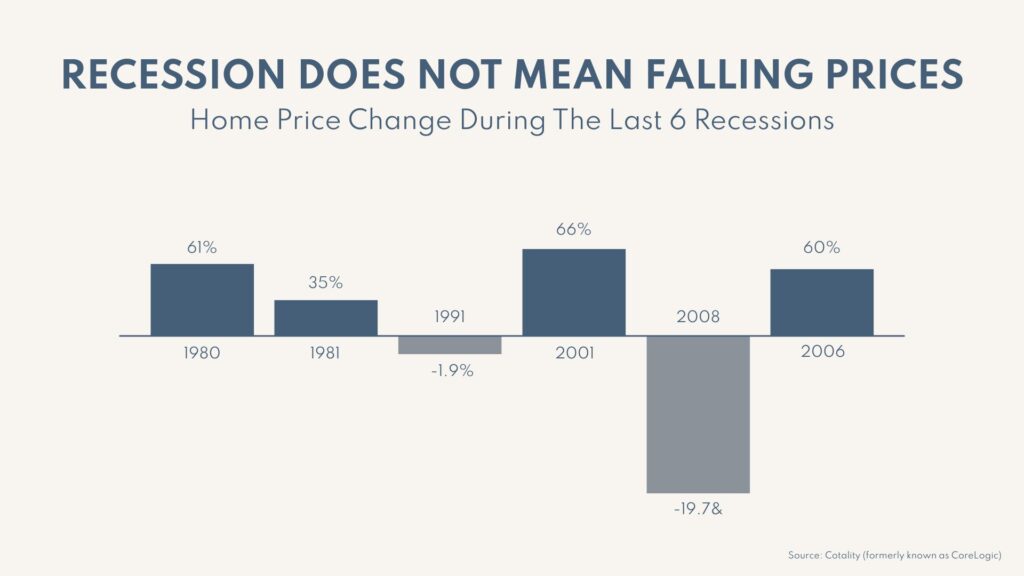

So what (for housing)? Recessions historically don’t mean falling home prices. See the chart that follows, and this is particularly true in supply-constrained markets, like the Bay Area. We’ll be watching Q2 data (due late July) for signs of a “shallow” recession that could also help lead to lower rates, benefiting home buyers (yet also likely spurring more competition).

Consumer Confidence: An Ironic Silver Lining

April’s University of Michigan Sentiment Index hit 50.8, among the lowest readings since the 1970s.

However, it’s important to consider that, historically, sentiment troughs like this have preceded an average +24% S&P 500 lift over the next 12 months. (AKA: Historically, when consumers feel the worst, the next 12 months of stock market performance tend to be strong.)

So what (for housing)? A rising stock market boosts the “wealth effect,” supporting buyers’ equity positions and strengthening home-price resilience. Low confidence now may argue for a stronger housing backdrop 6–12 months out.

Interest Rates and Mortgage Implications

Despite economic headwinds, the Federal Reserve has maintained interest rates between 4.25% and 4.50%, citing persistent inflation concerns, particularly in core services. (Headline CPI sits near 3.5% yoy, well above the Fed’s 2% target.)

The Fed continues to hold policy rates at 4.25–4.50% — and Powell indicated that they may even push out any potential rate cuts until late 2025.

We’ll be watching the next CPI & PCE prints (mid-May): A cooler-than-expected print could spark talk of a cut; anything hotter will cement “higher for longer.”

But, that is all about short-term rates. Mortgage rates are long-term rates, and they aren’t always directly correlated. That said, in this case, mortgage rates have responded accordingly, with the 30-year fixed rate hovering around 6.9%, clearly up from pandemic-era lows.

Bay Area Real Estate: Resilience Amid Uncertainty

The Bay Area housing market shows signs of resilience, though regional variations are becoming more pronounced:

In Santa Clara County, the median home price reached $2,000,000 in February 2025, reflecting a 10.6% year-over-year increase. Sales activity also showed a modest uptick of 0.7%, indicating sustained demand, despite higher prices.

San Mateo County experienced a 14.4% annual increase in median home prices, reaching $2,200,000. However, sales declined by 9.0%, suggesting affordability constraints may impact buyer activity.

In contrast, San Francisco saw a modest 0.6% year-over-year increase in median home prices to $1,600,000, with sales rising by 2.2%. That said, there are considerable variations, neighborhood by neighborhood. Notably, areas like the Sunset District, West Portal, and Miraloma have been hotter recently, attributed to their family-friendly environments and limited new housing developments.

Alameda County maintained a steady median home price of $1,300,000, with a 2.8% increase in sales, indicating a balanced market.

Conversely, Contra Costa County experienced a slight 1.1% decrease in median home prices to $841,000 and a 1.8% decline in sales.

Finally, in the North Bay, Marin County’s median home price rose by 4.0% to $1,675,000, accompanied by a significant 17.4% increase in sales, suggesting a robust market.

Inventory and Market Conditions

Inventory levels vary across the region. The East Bay has seen a surge in listings, with Alameda County experiencing a 21.59% increase in new single-family home listings and a 26.39% rise in active listings. Contra Costa County’s condo listings increased by 26.42%, with all active inventory up by 38.24%.

In contrast, San Francisco continues to face tight inventory, with only 1.1 months of single-family home supply and 2.8 months for condos, maintaining a seller’s market.

Santa Clara County remains highly competitive, with single-family homes averaging just 12 to 32 days on the market, reflecting strong buyer demand.

Strategic Insights: Navigating the Market

For Buyers

- Opportunities in Specific Neighborhoods: Areas with increased inventory, such as the condo market in Silicon Valley, may offer more options and negotiating power.

- Long-Term Perspective: With mortgage rates expected to remain elevated, focusing on long-term value and affordability is crucial. It’s also important to consider how long you may be in the home and aim to “get ahead” of other prospective buyers.

For Sellers

- Timing Advantage: Low inventory levels can work in your favor, especially in high-demand neighborhoods. With such rapidly changing macro economic factors, it is also important to be ready to move quickly and remain flexible! (The good news is that we can turn a property around to be prime for going to market MUCH quicker than industry averages!)

- Market Readiness: Preparing your property to stand out is essential, as buyers can become more discerning amidst economic uncertainties.

Understanding the interplay between macroeconomic trends and the local real estate market is key to making informed decisions. Whether you’re considering buying, selling, or simply want to discuss how these factors affect your real estate goals, I’m here to provide personalized insights and guidance.

Let’s connect to chart the best course for your real estate journey in 2025, and beyond!

Cheers,

Best Coast Collective

OUR COLLECTIVE WINS

2 units | $1.655M

Portero Hill, SF

We scored this killer duplex for the sweetest fam! They’re moving into a baller unit and will be pulling in thousands in passive income from the other…💸 Talk about smart real estate choices. Major win!

2 beds | 2 baths | $1.595M

Van Ness, SF

Snagged this stunning condo for nearly $100K less than what the sellers paid in 2017! 🏙️ So pumped for our buyers, what an absolute win!

2 beds | 2 baths | $1.225M

South Beach, SF

Big congrats to our awesome clients who just scored their very own SF crash pad! 🌁✨ With the city heating up, they wanted a fun spot for weekend adventures, dining, and city vibes … mission accomplished. Living the best life!

2 beds | 2.5 baths | $1.325M

Russian Hill, SF

Got this beauty sold off-market for a great price – and the best part was the buyers were able to assume the seller’s loan…so they not only got a gorgeous new home, they also were able to finance it at a 3.5% interest rate!!! 🙌🏻Sometimes magic happens…and we’re here for all of it! ✨