Is your dream of buying a home feeling out of reach because of high interest rates?! Well, we have a tip for you…

We believe that, “If there’s a will, there’s a way.” So, let’s get creative to get you a home! We know that you don’t want to feel “house poor,” so here’s an idea to help you see more money each month…

How it Works:

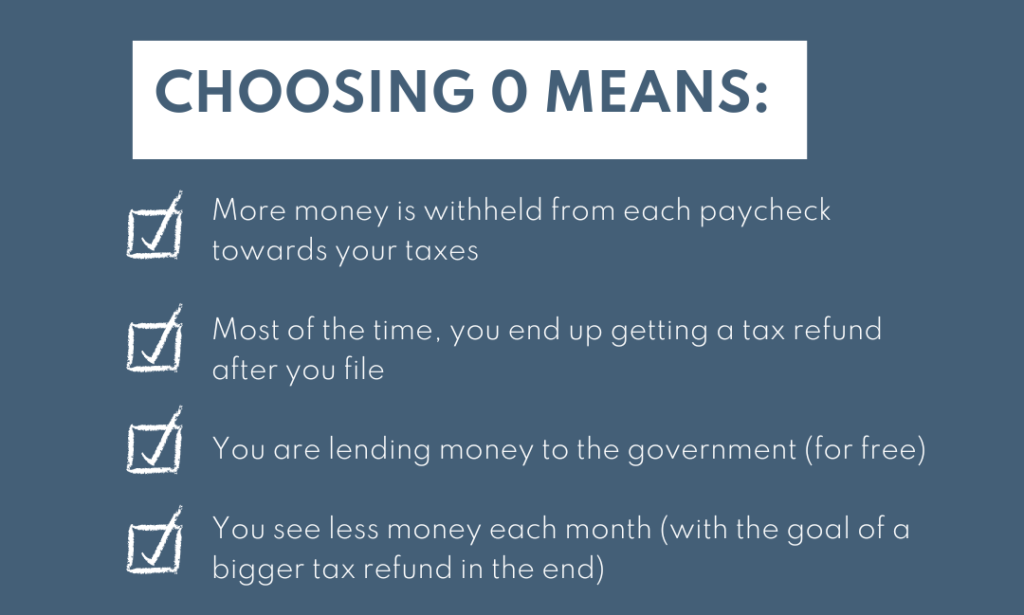

As a W2 employee…when you get hired, you fill out a W4 form. This is where you designate how much income tax you want “withheld” from each paycheck. It’s on a scale of 0-5, and many people choose 0.

If you increase your withholding amount (i.e., from 0 to 3), you’ll see more money each month. That extra money might get you into the house you want without feeling as cash poor.

Then, when you file your taxes, you’ll get tax deductions (against your W2 income) as a new homeowner. The goal is to have more spending money each month + net out even after you file taxes – AKA you don’t owe any more to the government, and they don’t owe any to you!

Disclaimer: We are not tax professionals, and this is not tax advice. Please consult with your CPA or tax advisor to determine the best strategy for you and your personal circumstances.