The famous early 2000’s band has been forced to change its name. It will now be going by Dimeback. Thank you, Inflation. LOL! (Sorry for the cheesy joke, but I heard it the other day and had to share…)

So, why is everyone talking about inflation these days? Well, it’s a real risk right now, which has a very real impact on our lives, especially as it relates to owning a home.

To start, what is inflation? Simply put… it is when your dollar doesn’t go as far as it used to. (Remember how our parents always told us that a gallon of milk used to be 10¢ – and, that they walked through snow and uphill both ways to get it!) Now, you can’t even buy bubble gum for 10¢, let alone milk. That’s inflation.

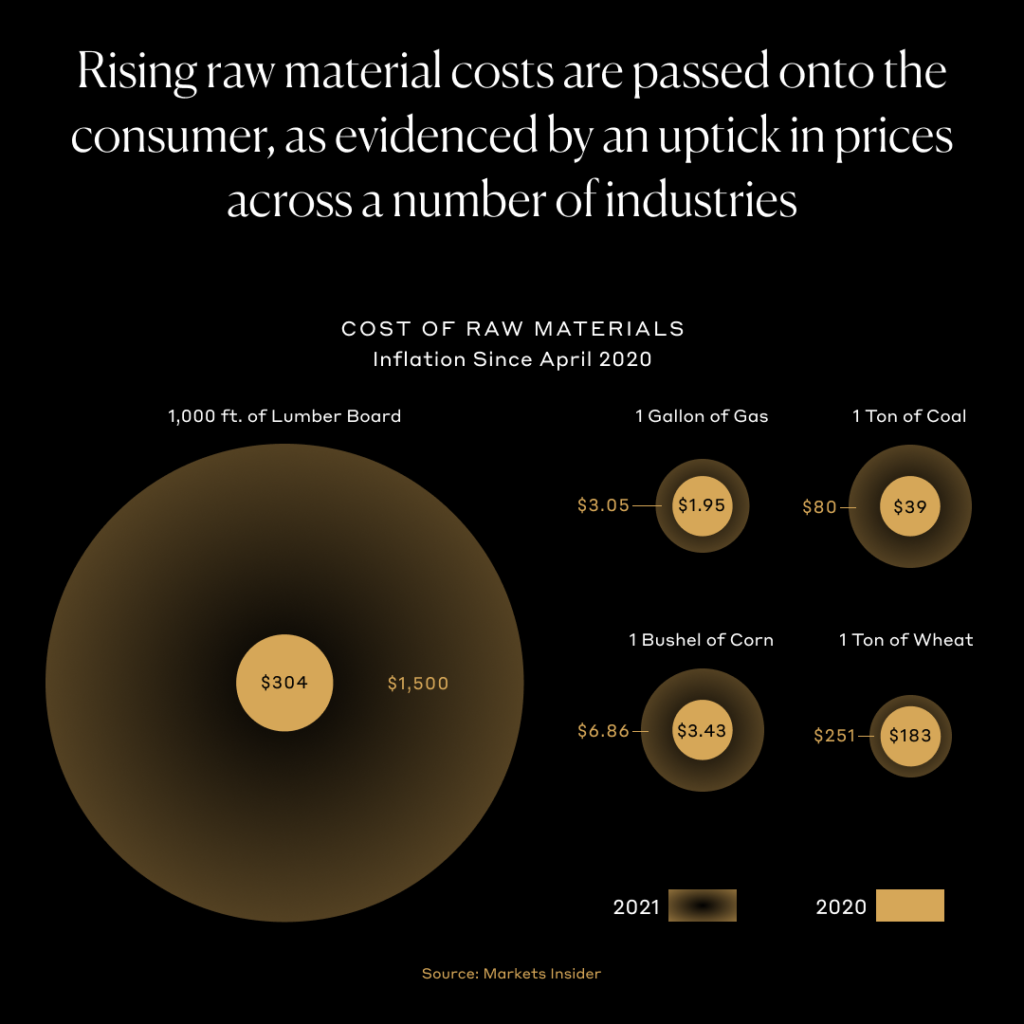

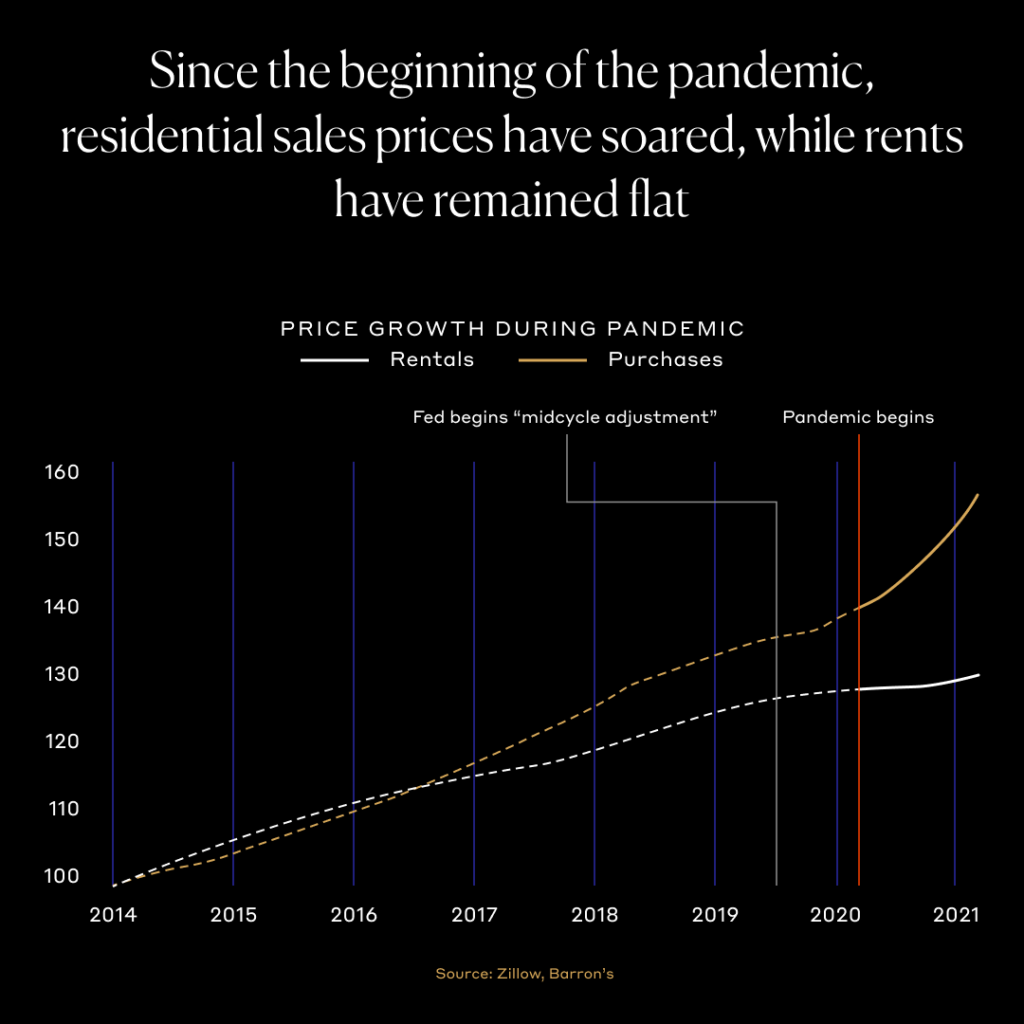

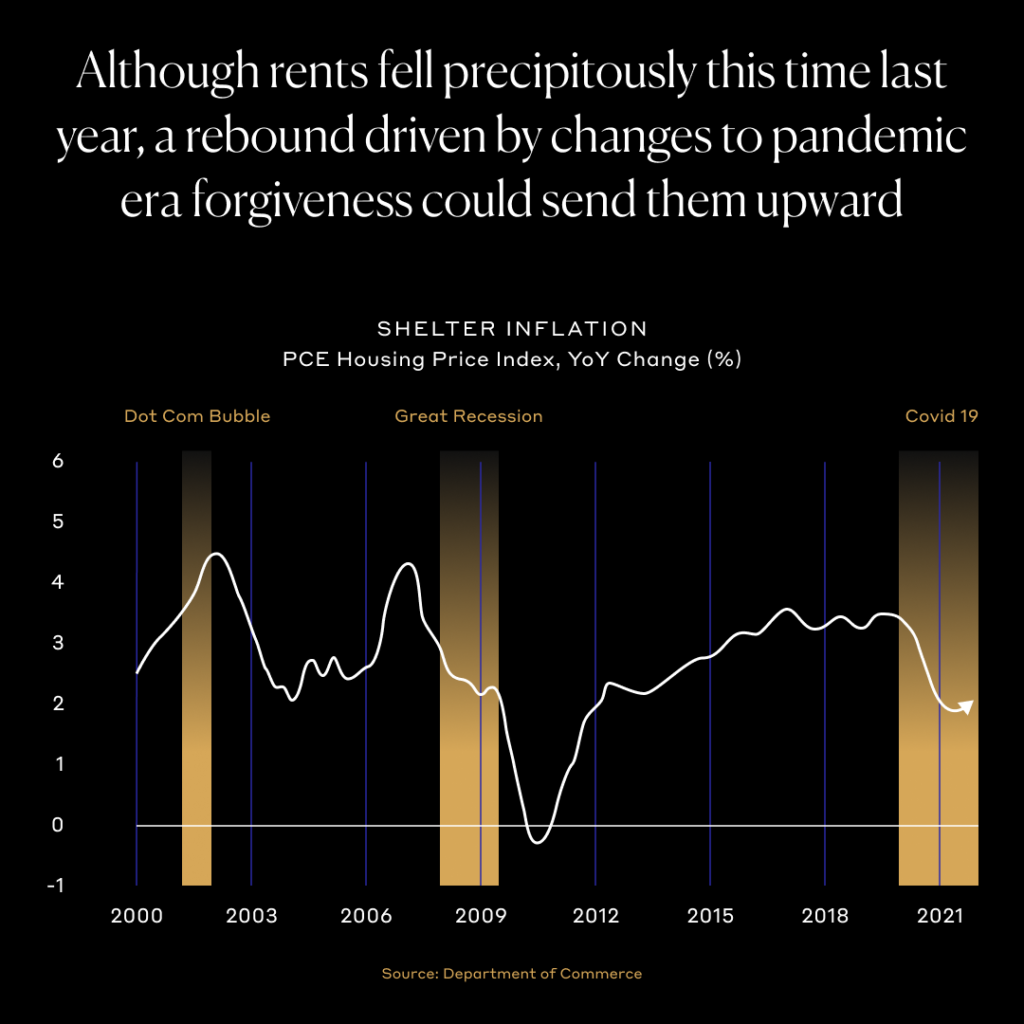

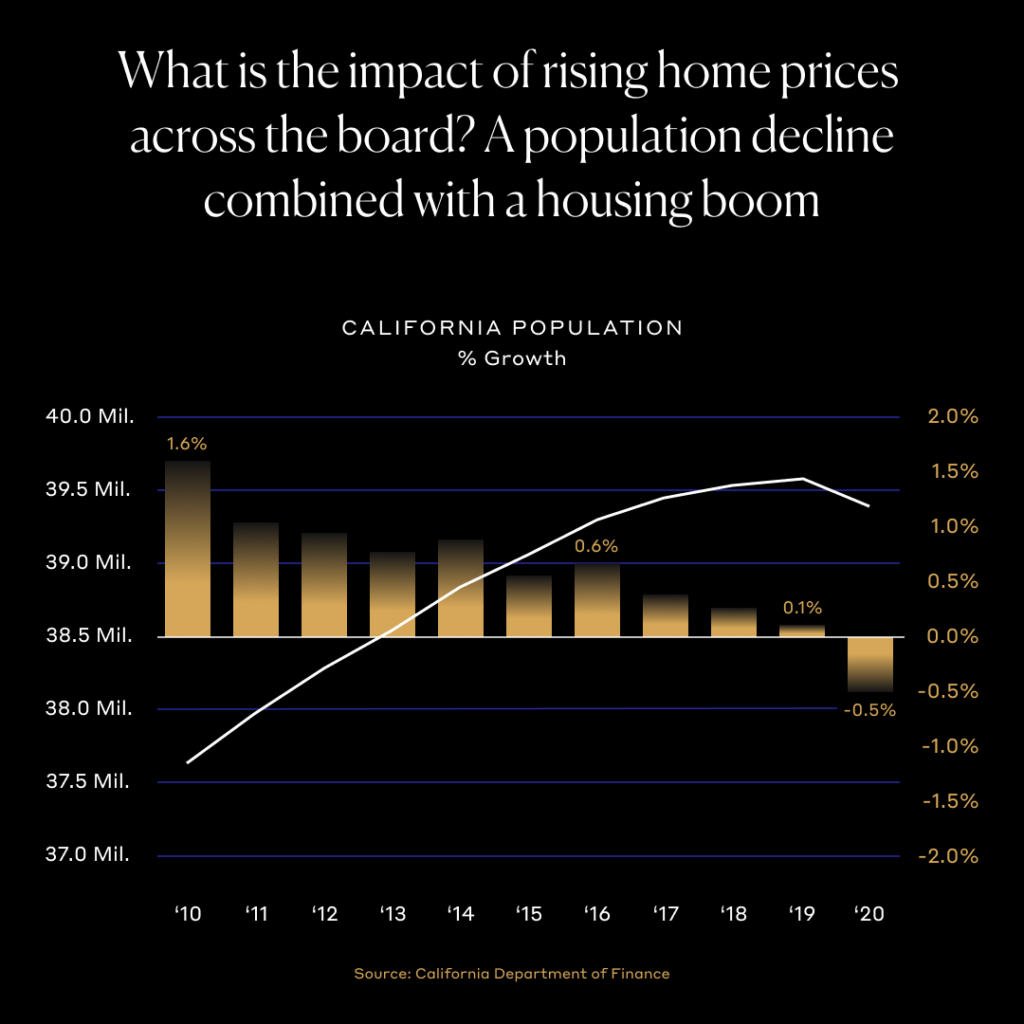

So, why now?! Well, particularly over the last year, money has been really cheap! (Although, the FED did increase rates last week.) People have been buying things (like homes), which increases demand and, therefore, prices. Plus, with the continued government stimulus efforts, a resurgence of economic activity (a.k.a. people going out to eat, wanting to travel, etc.), and rising material costs (materials and labor), most people think we are headed for an inflationary cycle.

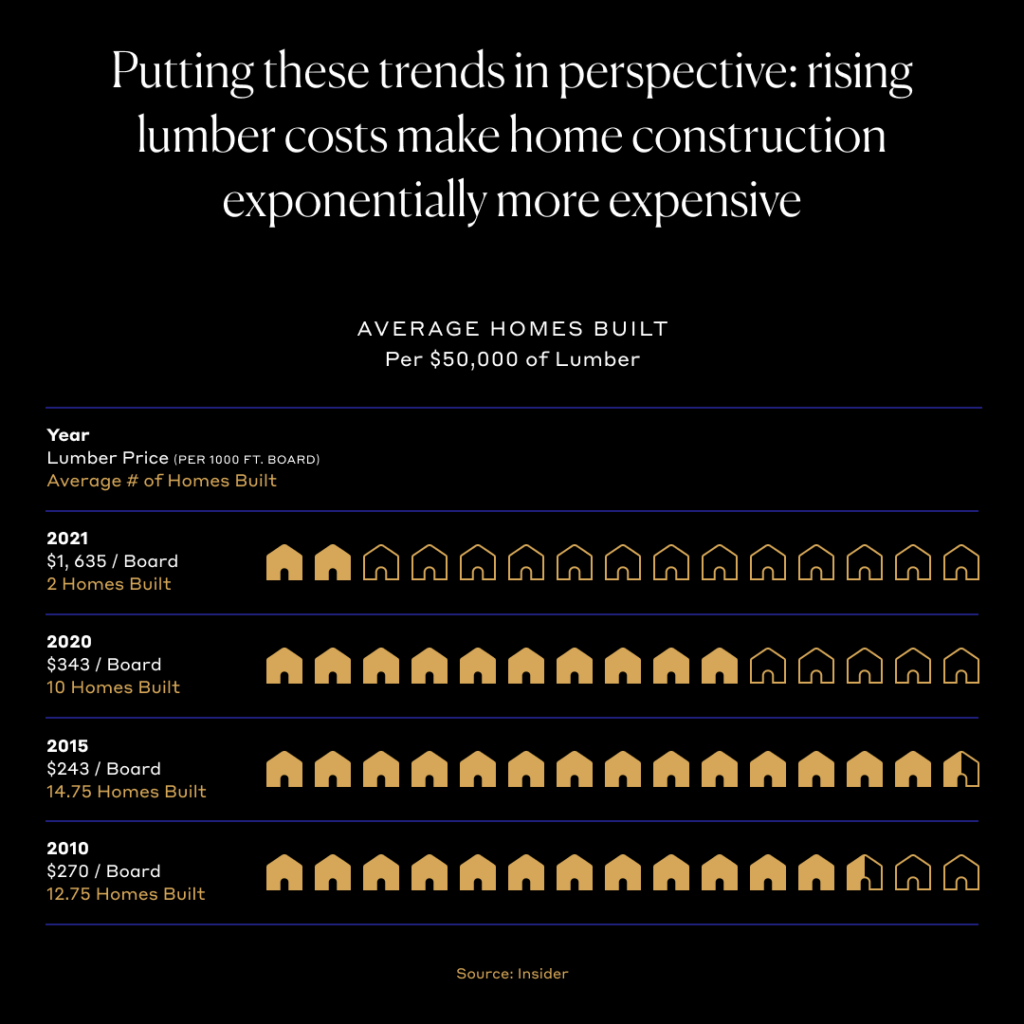

Did you know?! In general, the raw material cost that goes into building a home has increased about 65% in the last year. (So, it’s no wonder that there is an increase in home prices!) Also, there’s a general supply issue — the National Association of Realtors said that we have a housing shortage in the US of ~ 6.8M homes. WOW!

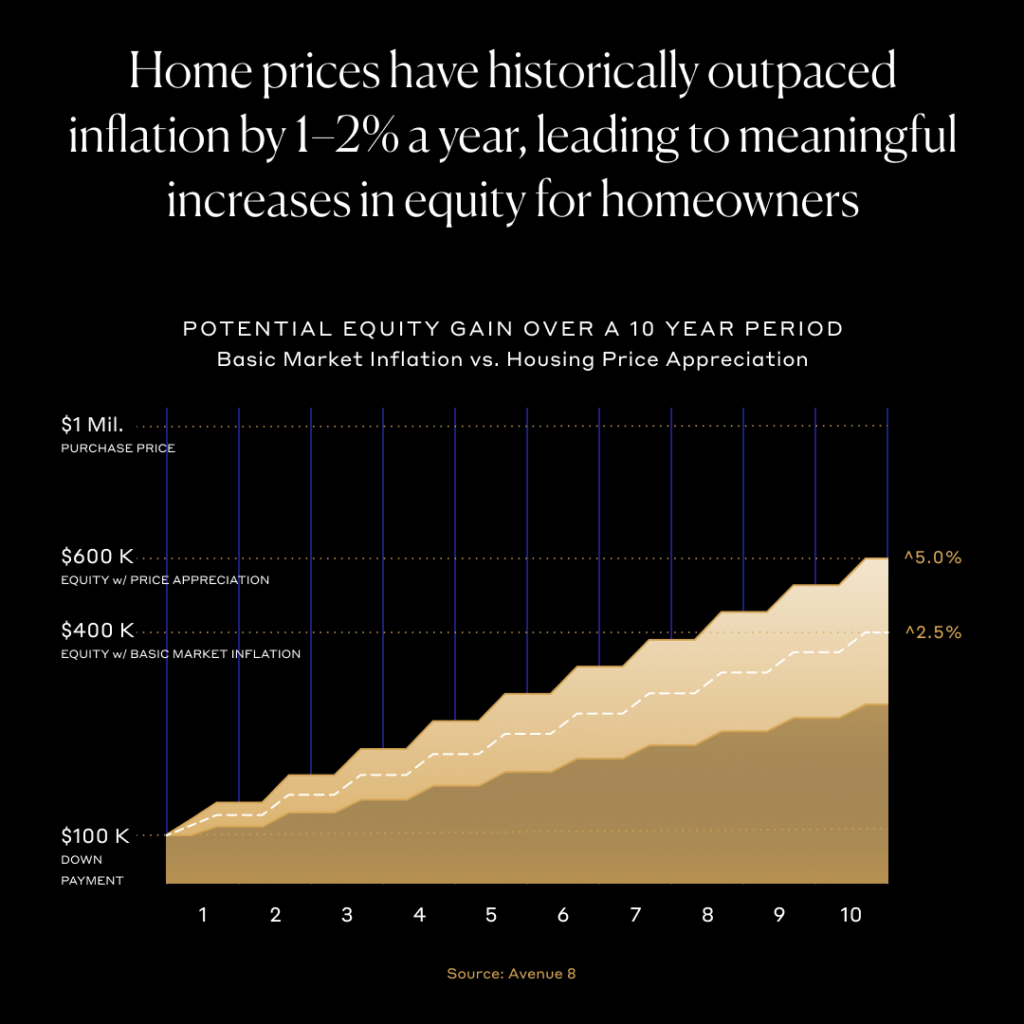

As a homeowner, inflation is your best friend. This leads to home price increases and more equity value for you. As we’ve seen home prices continue to rise (with no signs of slowing down), many homeowners are tapping into that by pulling money out of their home (a type of loan known as a Heloc). Then, they go and spend that money. With more cash to buy more goods, it furthers the inflationary cycle.

In short, it seems like this is going to continue for quite a bit, regardless of what the FED says about raising rates. This has plenty of implications for home buyers and sellers.

Want to chat? Don’t hesitate to reach out!

Have a great weekend,

Blakely

🇺🇸