In addition to crazy temperatures, it’s been a crazy September! Specifically, let’s talk about what is going on with these interest rates and a new learning about millennials that is a total plot twist. Plus, if you stay with us until the end, we included some informative data as we look towards 2025….

Here’s the TL;DR:

- Surprise #1: The FED finally reduced rates by 50 basis points, but mortgage rates went UP the next day – What happened? And, what’s happening with rates now?

- Surprise #2: Millennials, the generation that “spent all their money on avocado toast,” are now wealthier than any other generation at their age. This has been a recent and swift change – So, what changed? Where did this wealth come from?

Breaking it Down…

Let’s Start with Interest Rates:

The FED finally lowered interest rates on Sept 17th, BUT, mortgage rates actually INCREASED the following day. There were a few things at play…

The FED controls short term rates, not long term rates (aka mortgage rates). The bond market plays a big role in setting mortgage rates. Usually, the 10-year bond yield and mortgage rates move together. The bond market had been expecting several rate cuts this year, not just this ONE. And, because it was pretty obvious that the FED would lower rates in September, the bond market had actually ALREADY baked the FED rate decrease into their yields before the big announcement. Because of this, mortgage rates had already started to come down, even before the FED rate reduction.

Additionally, new economic data came out that impacted things. Housing starts (new homes being built) and single-family permits (permissions to build homes) were higher than expected. This is a sign that the economy is doing well, which caused the bond yield and, in turn, mortgage rates to rise.

Finally, the jobless claims data was better than expected, which again pushed bond yields even higher. The bond market reacts quickly to economic data and often predicts changes before the Federal Reserve does.

So, get ready for some fun times in the housing market next year!

Now, on to Millenials and their New-Found Wealth:

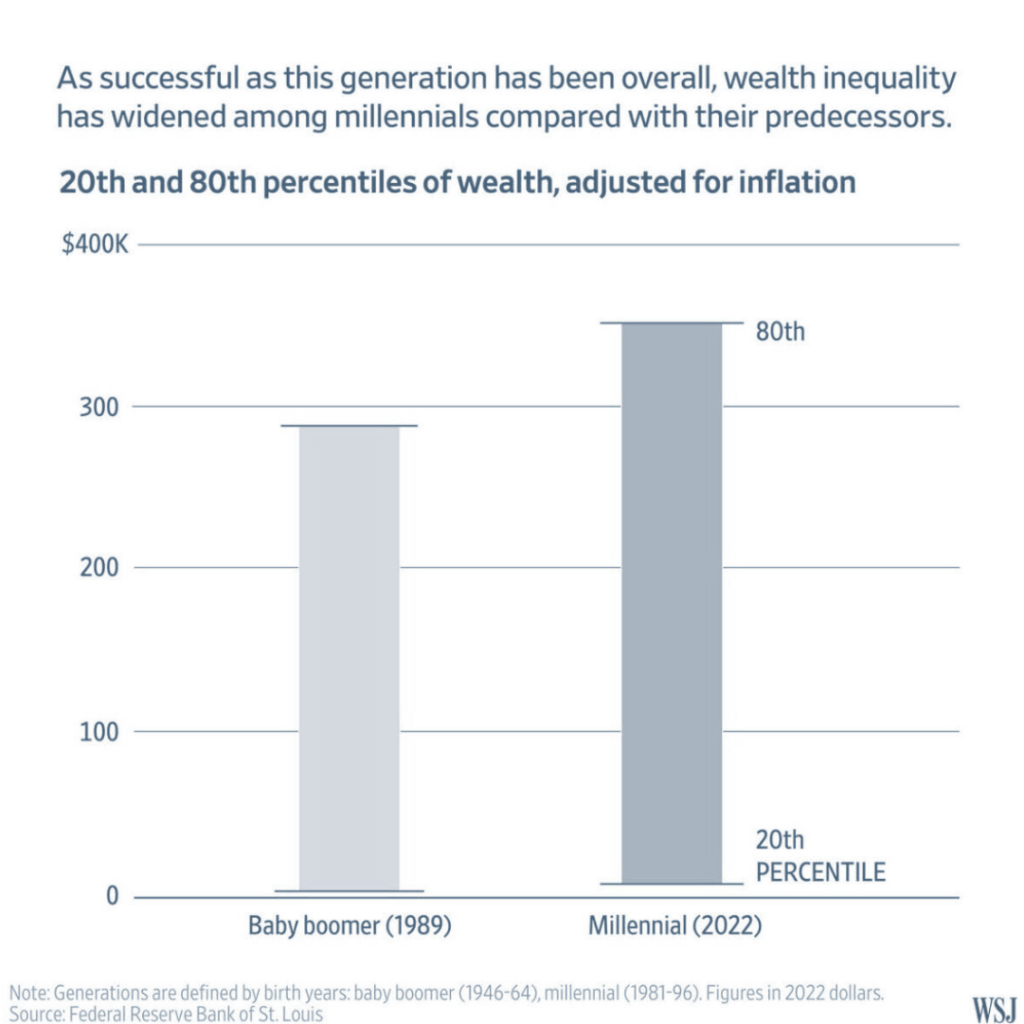

However, what is unique is the wealth gap across the generation, more so than their predecessors.

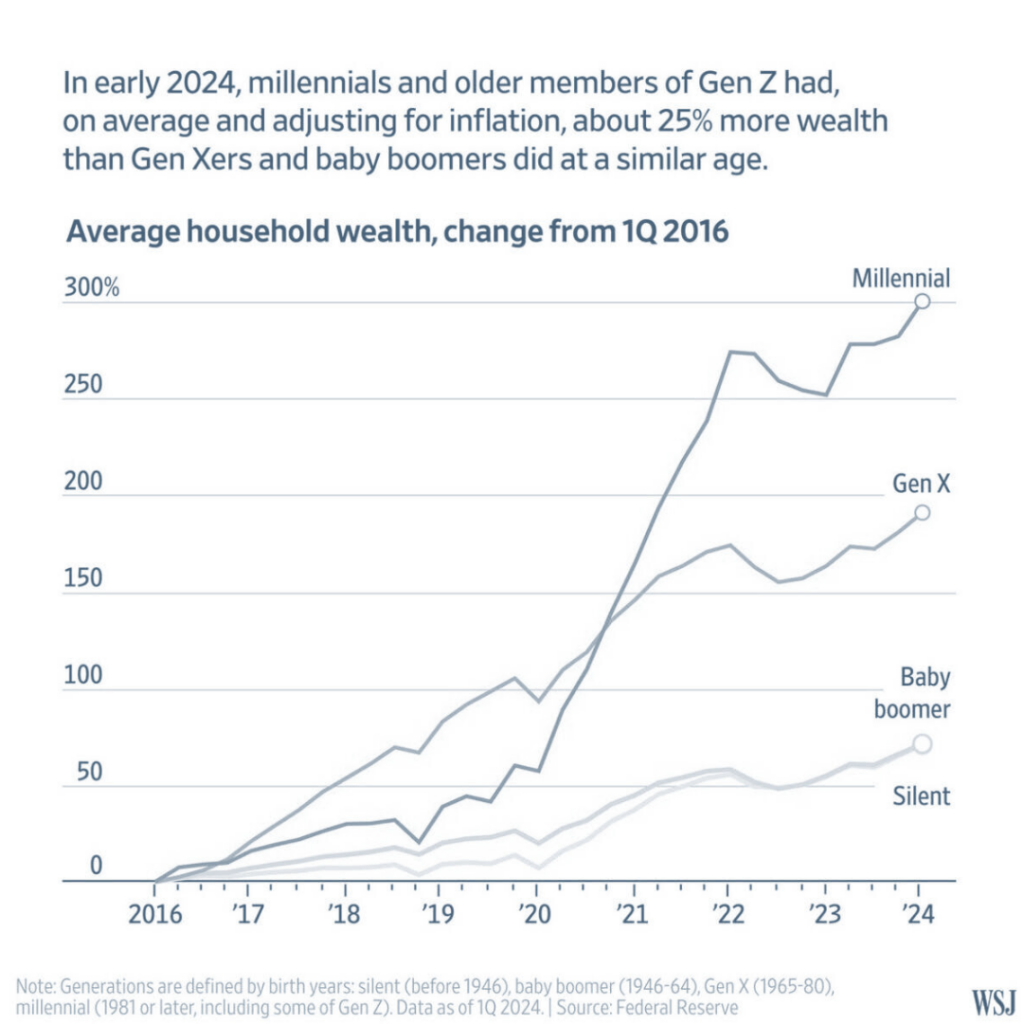

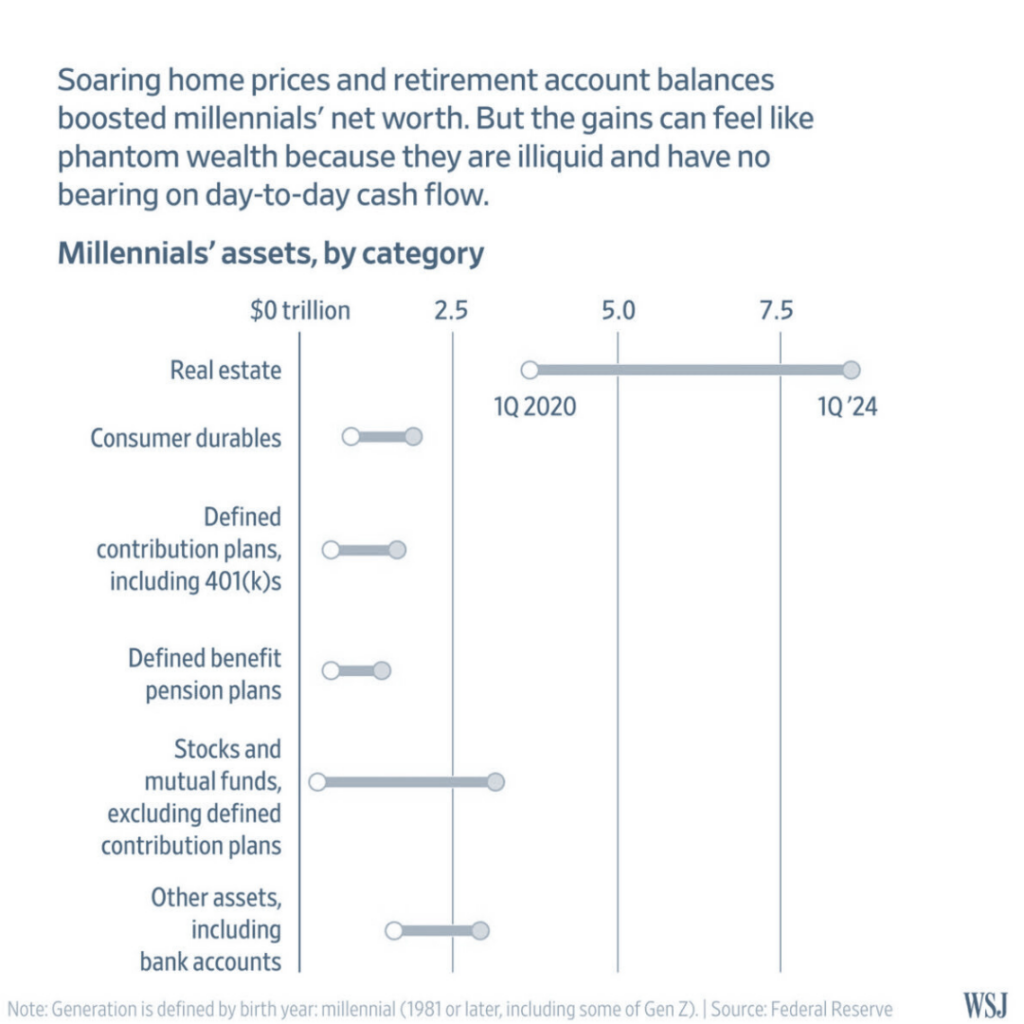

Millennials (now between 27 and 44 years old) were always thought to be perpetually behind. But, now…according to the Wall Street Journal, this change in the finances of Millennials has come quickly, thanks to soaring housing prices and smart investments. In fact, their median household net worth more than doubled from 2019 to 2022, according to inflation-adjusted data from the Fed Reserve Bank (St Louis).

So, what is setting apart the wealthy millennials and leading to their soaring financial success? If you guessed housing prices and homeownership, you’d be right! Those who have invested in real estate have seen greater wealth growth than those who haven’t. In addition, maybe somewhat surprising – we’re also seeing increasing retirement account balances among this generation, showing that some of that avocado toast budget is being put to better use! 😀

Speaking of getting into the housing market, let’s look at some key micro and macro stats, as we look ahead to 2025.

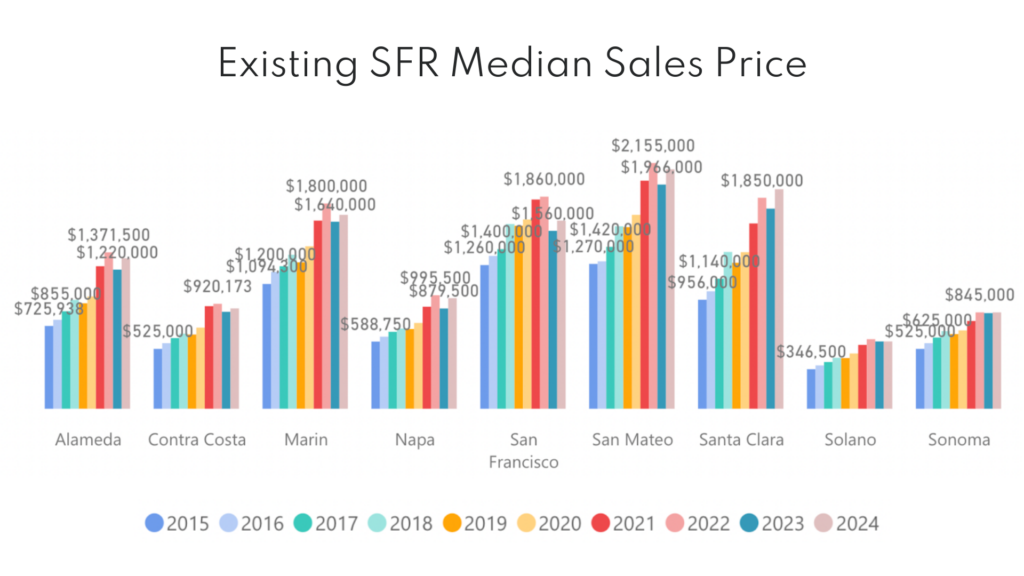

The TL:DR is that the number of sales and prices are both on the rise, but still down from the peak in 2021 (when you could still snag an historically low interest rate).

From a macro perspective, there are a few important things to note that give us hope as we look ahead: First of all, in September, the yield curve flipped positive, ending an inversion that had lasted for two years. That inversion had been the longest in U.S. history, lasting 783 consecutive days. This is a good sign for further reduced interest rates in 2025.

Additionally, financial markets appear to have greater confidence that the economy will avoid a recession in 2025. This “soft-landing,” as many are calling it, coupled with lower rates will really open up opportunities for buyers and sellers.

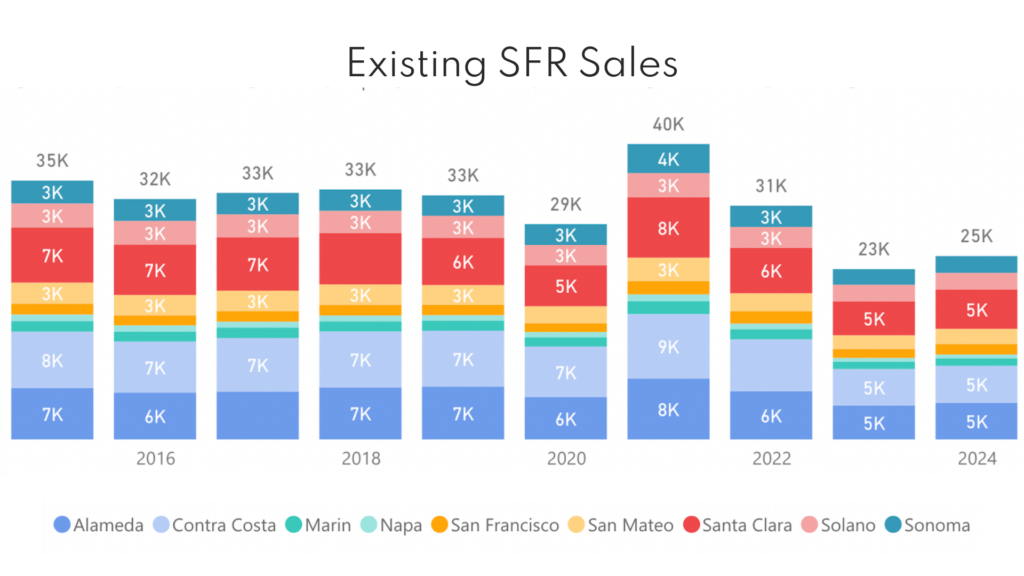

From a Bay Area local perspective, let’s take a look at number of sales and prices:

The number of sales is increasing, but still down a whopping 37.5% from the peak in 2021.

What about prices? Across almost all counties in the Bay Area, prices are on the rise again, in many cases actually catching up to – or even surpassing – prices from 2021-2022. Napa and Santa Clara counties represent the largest YTD median price growth at ~10%. Alameda County comes in at 8% YTD; San Mateo at 7%; San Francisco at 6%; and Marin at 4%.

So, what does all of this mean? Here are some early predictions for 2025:

- In 2025 across CA, the California Association of Realtors Economist team forecasts 304,400 single family homes to be sold, representing an increase of 10.5% from 2024’s projected pace of 275,400.

- CA’s median home price is forecast to climb an additional 4.6% next year. A persistent housing shortage, combined with increased demand as rates come down will continue to put that upward pressure on home prices next year.

- More options will hit the market, as rates come down and the lock-in effect loosens up some. However, it will be a moderate increase, not a surge in active listings.

Ok, that’s enough! Thanks for reading. As always, reach out with any questions about your unique situation. We’re always here to help!