Guess what? I have some good news for you! And it’s not just that Santa is coming…

As we end this crazy year and look forward, the data is starting to show us some promising signs for 2024. Here’s what we’re seeing and what it means for you.

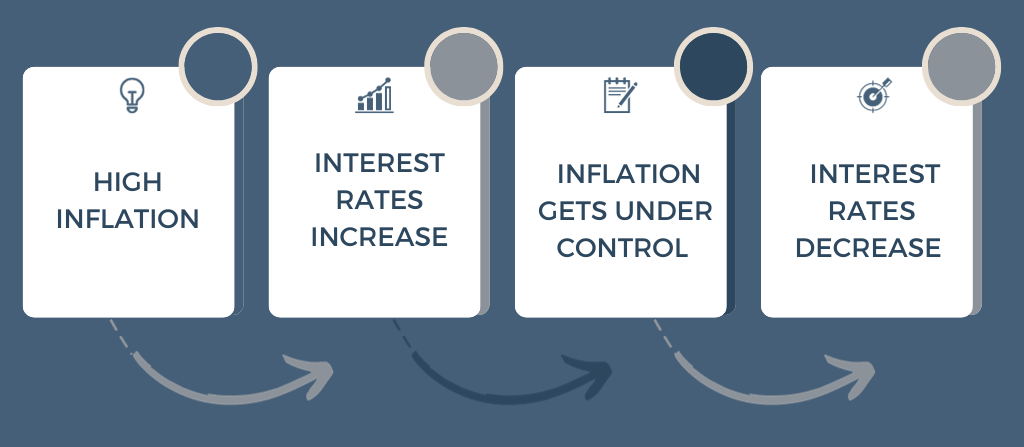

1. Inflation getting under control means we’ll start seeing lower interest rates.

I know we sound like a broken record here, but we’re finally seeing what we’ve been saying will happen. (Admittedly, though, it has taken longer for it to come to fruition than we anticipated.) Timing aside, it’s the age-old historic pattern:

The CPI data from a few weeks ago reported better-than-expected numbers, showing that all of the FED rate hikes are finally working. And, the jobs report has shown slower job growth. This is what the FED has been working towards. Now that it’s finally playing out, they have stopped with the rate hikes.

As a reminder, the FED only controls short-term interest rates (aka NOT mortgage rates), but the two are correlated. Mortgage rates have responded well to the FED’s latest pauses on rate hikes.

What’s more, the FED even said that they will likely start to CUT rates when appropriate next year.

With that, we expect rates to slowly drop throughout 2024. One caveat, though: it won’t be a straight downward line. With the election (aka, the inevitable media frenzy throughout the campaign trail) and the terrible and uncertain geo-political landscape, rates will continue to be volatile.

But, absent a black swan event, we anticipate the trend to be downward. Yay!

PS – We’re also seeing the spread widen between shorter loans and longer loans (i.e., 7-year ARM’s vs. 30-year fixed loans). This means that buyers have better options on the loan front and can find more ways to lock in lower rates.

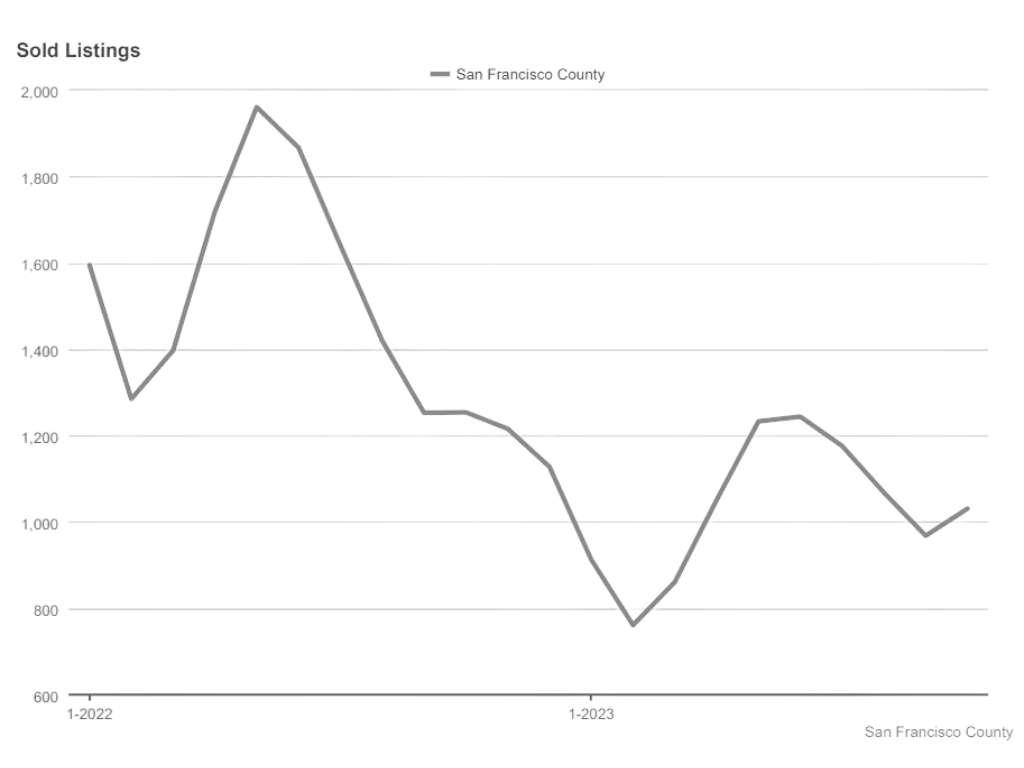

2. It seems that we’ve hit the bottom of the housing recession.

Housing recession? What do I mean? While consumers care about home prices and interest rates, the industry tracks the number of home sales. 2023 has been pitiful, to put it lightly. And, we get it…with rates in 7’s and 8’s, it’s been a hard pill to swallow.

We know what you’re thinking…”Why should I care about # of transactions? Shouldn’t that really only be something realtors care about?”

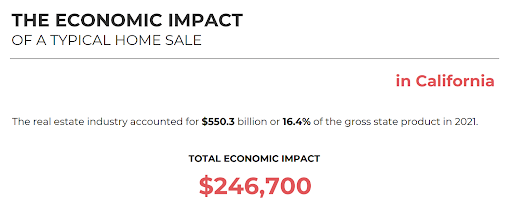

Yes…we, of course, do care about that. But, so should you. According to the 2022 economic impact report released by the National Association of Realtors, every time a home is purchased in California, it adds an average of $246,700 to the economy.

(Think: home renovations to prep the home for sale, taxes on the closing, new furniture purchases, moving costs, etc..).

It’s no secret that the economy hasn’t been great this year – while it’s performed better than expected, given all of the macro-factors, but have been (and continue to be) teetering on a recession. Housing is one of the best drivers of the economy, which is why a lot of housing lobbyist groups have been pushing the FED to stop raising rates for many months. With rates trending downwards, housing becomes more affordable. Therefore, the number of sales increases and more money flows through the economy.

The other reason why we’re confident that there will be more sales in 2024 is the fact that life events continue to happen. The majority of residential home sales are triggered by life events (i.e., getting married, having kids, job changes, getting divorced, death, etc.). We’ve had countless conversations with sellers in 2023 where they wanted/needed to sell their homes. But – given the market and the rates to buy a new one – they decided to wait. People can only wait so long, and we predict a number of sales due to this.

3. There will be a more balanced housing market next year (which is good for buyers and sellers!)

For all the reasons mentioned (and more), we believe that 2024 will be a much more active real estate market. This means that buyers will finally have more options; yay! But, in many cases, buyers will no longer have the luxury of time. If they find their perfect home, they will need to be ready to pounce before someone else does.

As such, we expect the average number of days a home is on the market to trend downward, meaning that sellers who buy their next home before selling their current one can do so with more confidence and with less time having to carry 2 mortgages.

Did you know? Every 1% decrease in mortgage rates equates to ~5M more prospective buyers. Every 1% increase in mortgage rates equates to ~5M fewer prospective buyers.

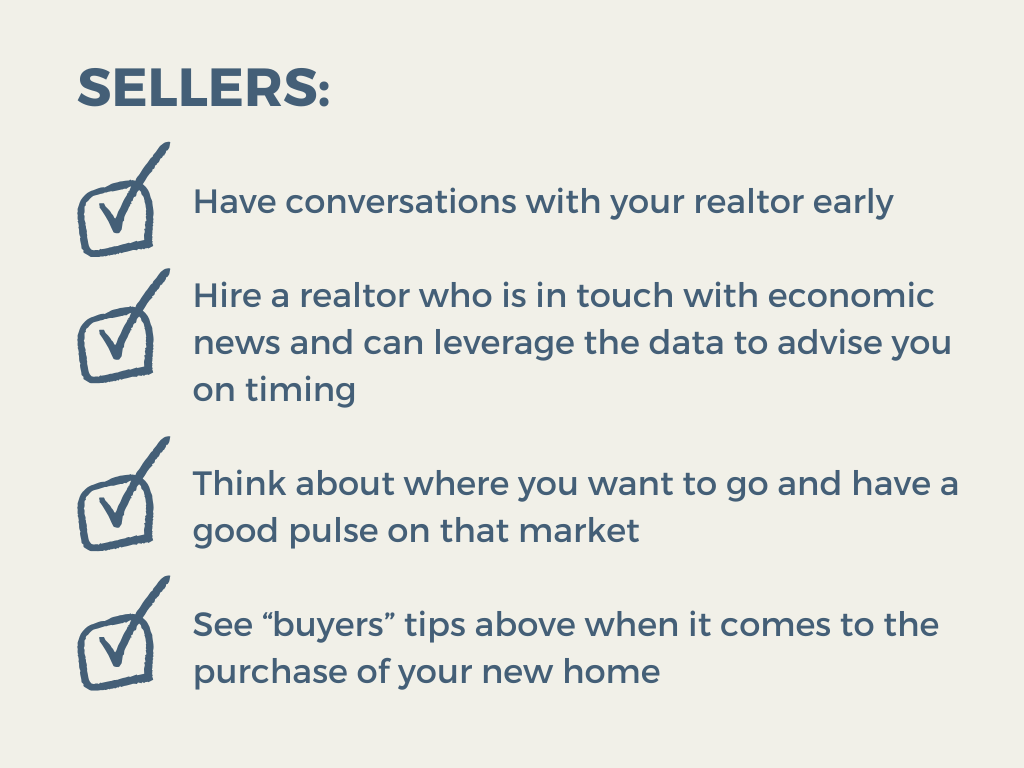

So, if you’re even thinking about buying or selling in 2024, here are our expert tips for you:

We wish you all a WONDERFUL Holiday Season!