Let’s have some real talk about the election and the housing market….

I have heard so many potential clients make statements like, “I’m going to wait to see what happens with the election before I make a move.” Or, “Rates are coming down…I’m going to buy after they drop some more.”

When I ask people to double-click on “why” they feel that way, I’m usually met with blank stares or stutters.

In short, I couldn’t disagree more with these two schools of thought, and I’ll tell you why below. As always, our goal is to set the record straight on housing matters! We want YOU, our clients, to focus on the facts. And, once you’re well informed, then make the decision that is best for you! On that note….here are some facts:

By the numbers

What Impacts the Bay Area Real Estate Market?!

Let’s break down the factors that truly shape our housing market. Understanding what drives the market enables you to make informed decisions.

The Macro View: Unpacking Election Results Hype

Before each election, there’s always a lot of chatter and nerves around who will win and how that will impact our lives, including our biggest financial assets – our homes. This anticipation usually fuels a lot of market speculation (which is what we’re hearing from our clients, as noted above). However, historical data tells us that there is no significant correlation between election results and short-term housing market performance. From a housing data perspective, it actually doesn’t matter whether there is a Republican or Democrat in office.

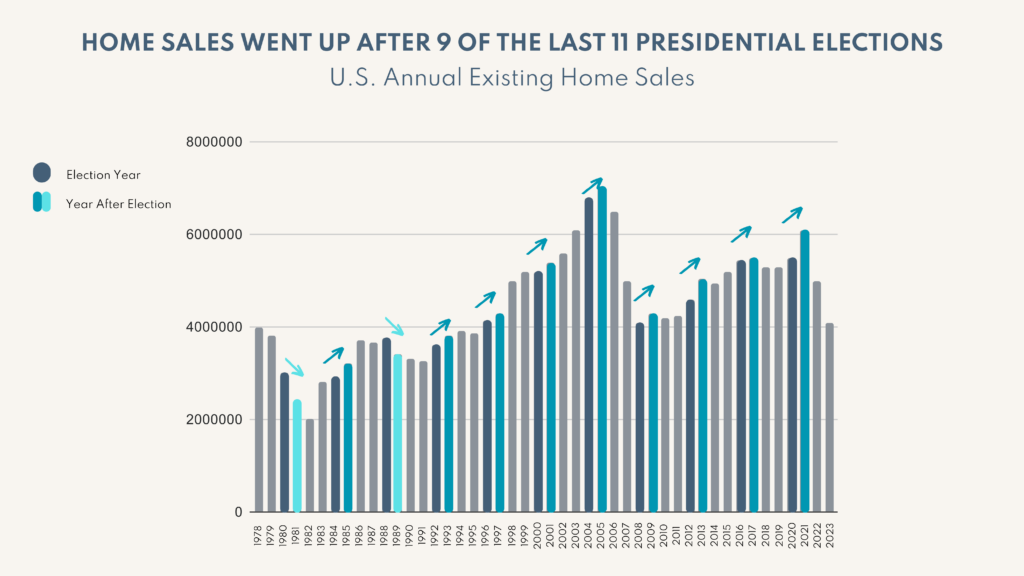

So, what typically happens post-elections? There are some trends in the data: According to Keeping Current Matters, (a company that focuses on real estate market insights)… the volume of home sales in November of a Presidential election year typically slows down slightly. However, they go on to say that this slowdown is temporary, and the data shows that sales volume usually picks back up by the end of the year.

Then, we see sales volume continue to rise as time goes on. Here’s a graph from The Department of Housing and Urban Development (HUD) and the National Association of Realtors (NAR), showing that the number of home sales increased in the year after the election in 9 of the last 11 Presidential elections:

n short, people put a lot of weight on the election results, but then – once the dust settles – things typically go back to normal.

We all know that the housing market is hyper-local. The Real Deal shows why these results can be true, regardless of who is in the office: “No president can simply sweep away laws and regulations. The rules that limit homebuilding are largely on the state and local level.” -Erik Engquist, The Real Deal (full article here)

Not to mention… while housing is a topic that both Trump and Harris have discussed, as we saw with the debates this week, we really haven’t heard a whole lot of specifics from either of them on their proposed policies. Even if we had, we’d be making some big assumptions: 1) that they would follow through on exactly what they said; 2) that the winning candidate would have enough support in the Senate and the House to pass their proposed policies; and 3) that the changes would impact all state and local governments equally. Those are BIG assumptions.

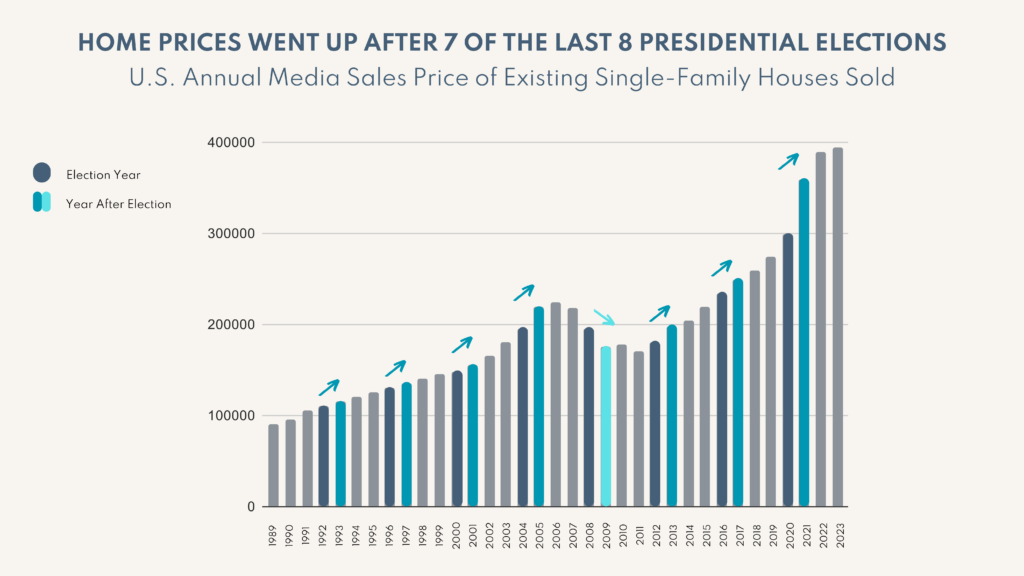

But, that is about the volume of sales. Let’s look at what happens to home prices:

Data shows that home prices went UP after 7 of the last 8 Presidential elections. Again, this is true, regardless of whether a Republican or Democratic was in office:

So, if you’re waiting for the election to potentially see a crash in prices or feel that WHO wins will have a big impact on the local housing market, the data doesn’t support that.

Let’s look at some other factors that also impact the market…because there are other dynamics at play, not just the election…

Interest Rates: The Real Game Changer

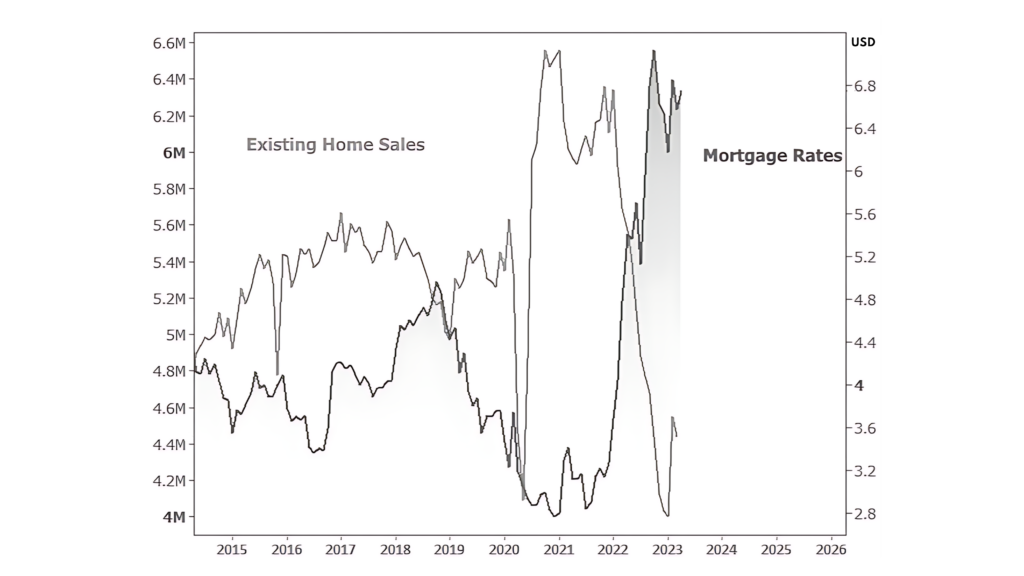

As we saw in the pandemic with rates at historic lows, interest rates are the real pulse of the housing market. With inflation being what it has been for the last 2 years and the recent jobs reports coming out – there are economic factors that will likely lead to the FED lowering interest rates for Q3 of this year and more drops in 2025.

Here's a stat to consider:

For every 1% decrease in interest rates, 5 million additional buyers enter the housing market nationally.

So, imagine the potential impact if we see a significant rate drop. For context, the graph below shows the relationship between interest rate movements and the number of home sales over the last decade. You can see the inverse impact.

Tech Stocks & IPOs: More Cash In Our Pockets

Let’s look closer at a big Bay Area influencer: Tech valuations and IPOs. As we have seen over the years, these can have a very real impact on our local housing market, due to our tech-driven economy.

With the exception of Reddit, it’s probably been a while since you’ve read about an IPO happening or had a friend who was early at a startup come into some money. Right?

While we certainly don’t have a crystal ball, there is a lot of talk about the IPO window opening back up in 2025 after years of companies waiting on the sidelines, trying to preserve cash. If this does happen, we expect it will translate into higher demand for housing as newfound wealth prompts home purchases and upgrades.

Insights for Buyers

and Sellers

Buyers:

- Monitor interest rate trends closely. Lower rates can significantly enhance your purchasing power, but will also impact the competition and, therefore, the price you pay for the home.

- Stay updated on tech sector performance, as it can predict upcoming local market shifts.

- Consider the broader economic indicators that might affect supply and demand, ensuring you’re timing your purchase optimally

Sellers:

- Leverage periods of high-tech stock performance to list your property.

- Even in a high-demand market, pricing competitively and preparing your home appropriately remain critical.

- Stay attuned to interest rate predictions and macroeconomic trends to strategically plan your sale.

In a market as dynamic as ours, staying educated and informed is key. If you have questions about your specific situation or want to chat about these insights in more detail, just reach out!

OUR COLLECTIVE WINS

SOLD

3 beds | 3.5 baths | $5.5M

We’re proud to have saved our client $400,000 on this exquisite property! With views spanning from the Golden Gate Bridge to Alcatraz to the Bay Bridge – plus 7 decks to soak them all in – we can see why our client absolutely fell in love with this one.

SOLD

5 beds | 3 baths | $1.75M

We’re thrilled for the buyers of this special home! But, it wasn’t straightforward. The listing agents priced it egregiously low to “see where it went.” What’s more, there really weren’t great comps. So, it took creative data gathering, negotiation skills, and a relationship with the other side to ultimately win this home for our dear clients.

SOLD

2 beds | 1 baths | $1.31M

We usually joke that part of our job is being a therapist. Well, it’s not a joke! Especially when multiple stakeholders are involved. For this one, we had to get both partners and one set of parents aligned. It took a lot of education, and a thoughtful search process, but the end result was perfect.

SOLD

2 beds | 1 baths | $1.05M

We were hired to take over this listing after 6 months on the market with no interest. Our client brought us in, we made some strategic changes, and re-listed it. Within a week, we received a great offer, which we negotiated above the list price! Our property improvements resulted in a 5X return. Needless to say, our seller is quite thrilled!