As the year comes to an end, and with a new administration in place, we’re all eager to see what’s on the horizon in 2025. We’re tracking things as they unfold (still lots of uncertainty!), but here is what our “crystal ball” 🔮 tells us for the real estate market of 2025.

The TL;DR for 2025

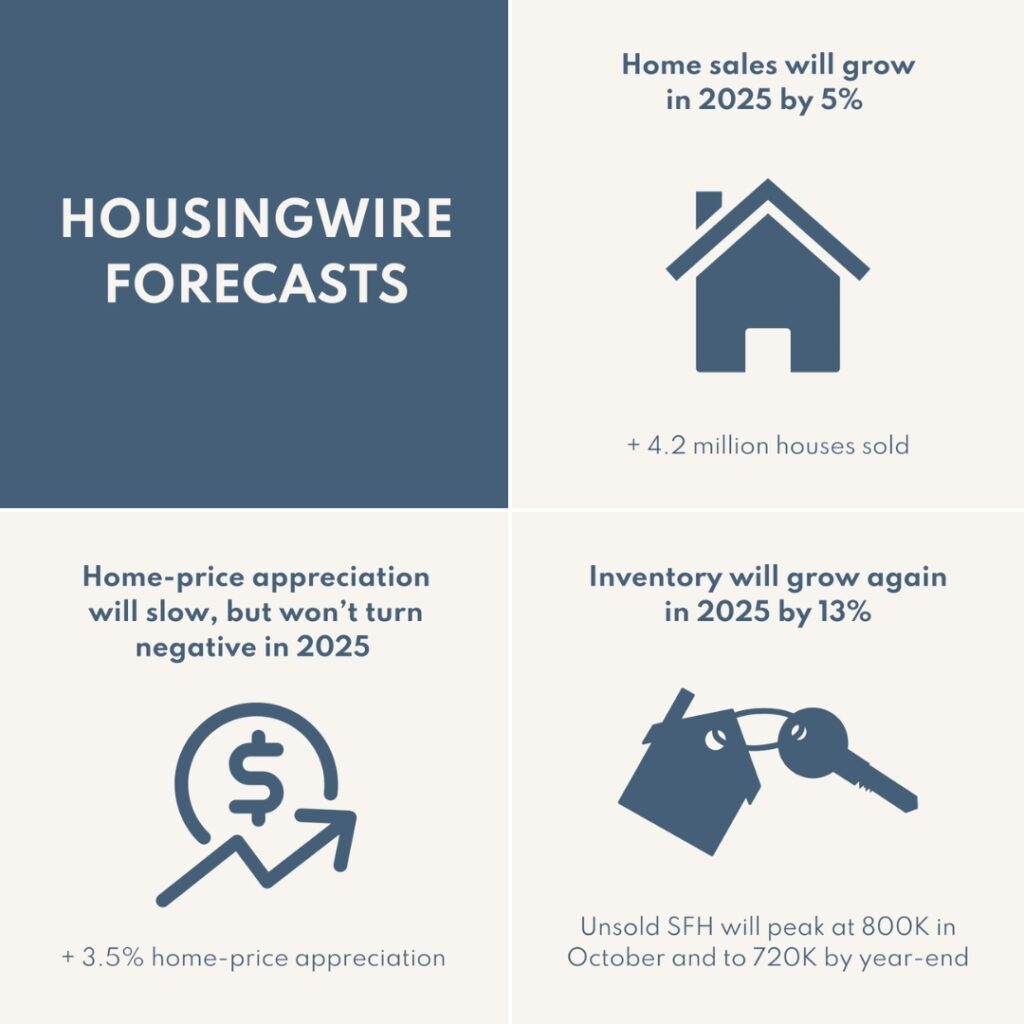

We are looking ahead with tempered optimism. Housing Wire – one of the industries top economic and data sources – put out the following national predictions for 2025:

Other assumptions about the housing market and macroeconomy in 2025:

- Continued slight easing in mortgage rates to a range of 5.75% to 7.25% during the year. This range implies that rates are not forecasted to dramatically deteriorate, and there’s no sub-5% rates in sight. The range accommodates variability for the ups and downs of economic news during the year.

- Moderate economic growth, with low probability of recession in 2025.

- Increased unemployment and less optimism on employment prospects.

- The mortgage lock-in effect slowly continues to lessen its grip on homeowners.

This is good news and, if it pans out, gets us closer to a pre-pandemic (read: more stable) housing market. BUT let’s dive into both some local dynamics that may impact our housing market and of course talk politics…

Economic Backdrop: Setting the Stage for 2025

Let’s get politics out of the way first (from a purely housing perspective)…we are and will very likely continue to be in an affordability crisis. Specifically in the housing sector. Large parts of the country, not just the Bay Area, are feeling the squeeze of inflation and rising housing costs and it’s causing a lot of alarm/frustration/tik tok videos about forever renters… 🙄 This is an old conversation for those of us in the Bay Area – we’ve been feeling it for years – but what is new is the rise of housing costs in other parts of the country that have traditionally been affordable: Texas, Florida, Montana…(A condo in Montana pre-pandemic appraised at $400k and that same condo is now selling for $1.5mil… 🤯 that’s over 3x in a very short amount of time) couple this with the last 4 years of inflation and emotions are running very high on this particular issue…all this to say housing affordability is top of mind for the next administration…

We’ve lived through this administration before, so we have a sense of what to see and expect. So, let’s look back to see what might be coming:

De-regulation to spur building (aka supply):

Back in 2019, the administration signed an executive order, titled “Eliminating Regulatory Barriers to Affordable Housing: Federal, State, Local and Tribal Opportunities.”

- “…because for many American citizens, the supply of available housing has not kept pace with the demand for housing by prospective renters and homebuyers. Rising housing costs are forcing families to dedicate larger shares of their monthly incomes to housing. In 2017, approximately 37 million renter and owner households spent more than 30 percent of their incomes on housing, with more than 18 million spending more than half of their incomes on housing. Between 2001 and 2017, the number of renter households allocating more than half of their incomes toward rent increased by nearly 45 percent.

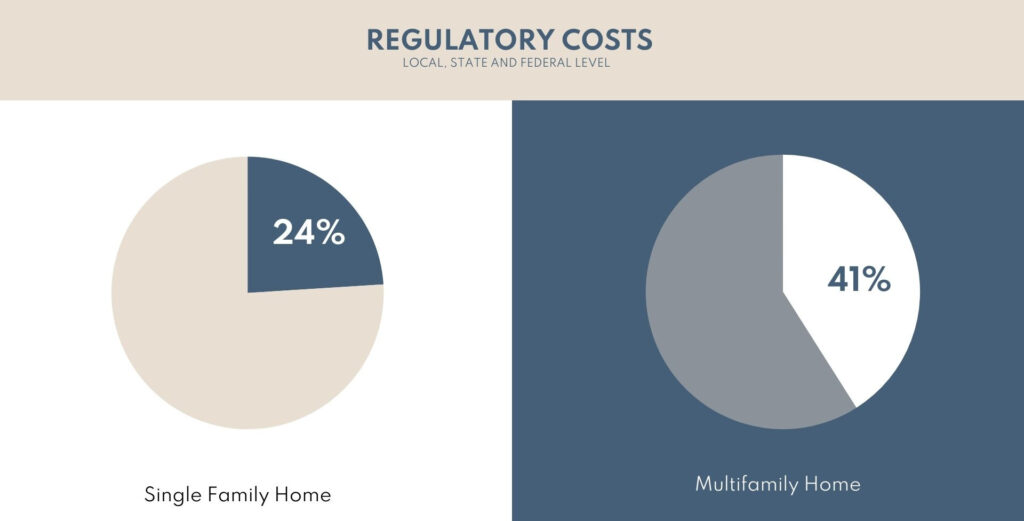

Here are some present-day stats and comments: Jim Tobin, the president and CEO of the National Association of Home Builders claims that:

Supply (or lack of supply) is still a problem…we’ll see if the new administration can make any material headway on this in 2025 and make it more affordable to build…

Tax Cuts and Jobs Act of 2017:

Everyone knows that the tax cut rates implemented were aimed at keeping more money into consumer pockets. It is very likely that the tax cuts will get extended in 2025. This will bring short term relief to consumers, couple this with the stock market rally post-election, and we expect to see some consumers in a better position to spend their money/buy a house. In the short-term people will have more cash on hand for 2025. (we know this isn’t a long-term viable plan but again we’re just looking at the next 12 months)

Additionally, we want to call out the Opportunity Zones identified under this 2017 Act …as a reminder Opportunity Zones were meant to spur investment in undercapitalized communities. The program provided three tax benefits for investing unrealized capital gains in Opportunity Zones…again the administration was in favor of making it more attractive to invest in real estate…so far there aren’t specific plans/details about how the next administration will be thinking about this, but maybe we’ll see an extension of this program (it expires in 2026) or something new to incentivize real estate investments?

Low(er) Interest Rates:

The 2017 administration had the lowest interest rates in my lifetime and possibly ever. I don’t think anyone needs data to see this as we all lived through it. Even though interest rates are controlled by the FED, many people associate low rates and affordability with this administration and have a positive association with it. There is a massive amount of pressure to reduce the cost of money and we’ll be watching oh-so-closely to see what happens while simultaneously keeping a hard stare 👀 at inflation. There is already some fierce grandstanding/posturing/defense (? – not sure what to call it) from the FED and the incoming administration…but only time will tell how this incoming administration can and will influence the FED to make housing more affordable through lower interest rates.

Here is what the NYT is reporting:

Okay so those are the 3 big housing topics we wanted to tackle regarding the administration change coming in 2025 – if anyone wants to chat more about just let us know and we can do so over a cup of coffee ☕ or a glass of wine 🍷…but now it’s time to pivot towards what we’ll be watching and what we’ll see locally…

What You Should Watch For Locally:

The Tech Market

AI is hot and only getting hotter 🔥. 2024 was the year of Nvidia and it’s all everyone is talking about in the Bay Area (or if you hang out with the scientists, it’s all about weight loss drugs 💊). We expect to see more AI startups getting funded and moving into offices spaces (we’re already seeing movement in the downtown commercial world to support this) and bringing workers back to the area. On top of this, Salesforce implemented a 5 day a week back in the office work policy 💼 and if they can do it without push back from employees, we expect more companies to follow suit for 2025. This is GOOD for our housing market and could be the boost that downtown SF needs. It feels like the SF doom-loop narrative is behind us 🎉 and people are and complaining about traffic again…yay! We are excited to see what 2025 and the tech (biotech too!) world does for downtown SF and subsequently all the surrounding areas.

IPO’s?!?!

On top of AI creating jobs – we expect that we might see some tech, energy, and healthcare IPO’s in 2025 – these events inject a lot of cash into our housing market and after 5 very quiet years we should be ready to start seeing these events once again.

The 3 things that make the housing market go around...

As you know – or should know by know if you’ve been reading these updates religiously, policies are going to have an impact on 3 things that will impact the housing market – which is why we care about them.

- the jobs market

- the bond market

- inflation 👀

All 3 of these factors impact mortgage rates which ultimately means we have buyers or we don’t have buyers…the statistic is for every +1% in rates we see 5,000,000 buyers pause 🛑 on buying and for every -1% we see them buy ✅…We will be keeping tabs on these to monitor the health of the housing market and guide you in your real estate goals. 🎯

In Summary…

What does any of this mean to me…

My goodness, we’ve blabbed on long enough but all this to say we are OPTIMISTIC about the local (and national) housing market as we head into 2025. All major economic housing groups see our key metrics getting closer to pre-pandemic numbers = a more balanced and healthy housing market. There always are short term highs/and lows and is very neighborhood specific here, but the big picture is we are on the up and up.

Reach out to dive into your specific needs/wants/dreams and we’ll connect one on one to come up with a strategy that’s tailored to your unique circumstances 🙂

—

PS: There is so much we aren’t talking about in this update so if you need more, let’s pour a stiff drink and catch up in person 🍸

OUR COLLECTIVE WINS

$3.155M | 4 beds | 2.5 baths | 2440sf

–

These clients crushed the real estate game! We started working with them in 2019. They had a long list of wants for their home. But, as is normally the case, their expectations, budget, and time constraints weren’t all aligned. We helped them buy a wonderful home, but they did make some tradeoffs. Fast forward a few short years, and that home has appreciated well, as have their incomes. We started shopping again a couple months ago. Get this: This home checks EVERY single box on their dream home criteria!! So, we beat out multiple offers and won it for them!

$2.4M | 2 units | 2820sf

–

We closed this one $100k below asking, WITH and additional $40k in seller credit towards closing costs. What’s more…this was a Veteran’s Loan! VA Loans rarely work in SF, because of all of the hurdles that the VA makes you jump through, but we got it done! As we always like to say, “where theres a will, theres a way!”